Back

Back

COVID-19 has shaken the proverbial tree of retail in America. Just a year ago, e-commerce was only a potential opportunity for growth for some businesses. Now it is necessary for survival, as many retail stores are closed or have stringent capacity guidelines to slow the spread of COVID-19.

The way forward is in omnichannel strategies – but do companies have workers trained to execute? Omnichannel strategies are expanding and changing for every company attempting to combat sale losses due to brick and mortar location closures. How companies adapt to the changes in retail sales, and train their workforces to execute them, will decide their future.

Surprisingly, despite the financial hardships caused by COVID-19, "total retail sales increased 6.9% to $4.04 trillion from $3.78 trillion the year before." Growth of this magnitude has not been recorded since 1999 [1]. Additionally, 2020 saw the highest e-commerce growth in over two decades, totaling $861.12 billion in online sales last year. This total is a 44% increase from 2019, nearly triple the 15.1% increase seen from 2018 to 2019. Online sales accounted for 21.3% of total retail sales in 2020. To put this in perspective, in 2019, online sales were responsible for 15.8% of total retail sales, and in 2018, only 14.3%. "The more than five percentage point gain in e-commerce penetration is by far the biggest year-over-year jump for US retail sales ever recorded. No other year has even reached a two percentage point gain in digital penetration" [2].

These record-breaking statistics show the importance of e-commerce's inclusion in retail's omnichannel strategy, resulting in advances across workforce digitalization, logistics, and fulfillment. To support this tremendous increase in online retail sales, a robust digital backbone and the skilled workforce to support it are needed.

What is An Omnichannel Strategy?

Omnichannel is a cross-channel content strategy that provides the customer with the same consumer experience regardless of what platform they purchase from, including but not limited to, a traditional purchase at a store, an online purchase shipped to an address, or an online purchase picked up at a store. In theory, the customer can buy from any channel and ship or pick it up anywhere—speed matters in an omnichannel strategy. A functioning system relies on transparency and alignment of data across all channels; for example, a consistent price of a product on all purchasing channels and transparent and accurate inventory numbers at any given location is essential for logistic and fulfillment needs [4].

Implementation of an omnichannel strategy is nothing new; however, COVID-19 ramped up the necessity for the use of underdeveloped channels in the retail strategy. Companies started incorporating this strategy nearly a decade ago, but many retailers are still behind and find getting their channels running smoothly together is a challenge. The most significant difficulties foreseen are inventory accuracy, forecasting demands, and, most importantly, obtaining skilled labor to support the retail industry's increasingly technological needs.

"56% of retailers identified inventory accuracy as a problem in their operation, and 65% said inventory planning to incorporate demand across channels was also a challenge. Inventory visibility and management are key to successful omnichannel operations because, by definition, orders are fulfilled through multiple channels, meaning aggregate inventory can get lost in the shuffle if systems are not in place to track inventory levels and locations" [5]. Retailers are finding solutions to overcoming the challenges of the omnichannel strategy. These solutions are investing in order management systems and upskilling their staff.

COVID-19 Still Throws Companies with Established Omnichannel Programs

The problem arising, even for retail companies that had established omnichannel operations, is that "the usual data e-commerce logisticians use to craft fulfillment networks are losing relevance in the current circumstances" [6]. In the decade before the COVID-19 related e-commerce boost, which resulted in "an additional $174.87 billion in e-commerce revenue in 2020" [7], the best practice related to the number of warehouses a company should have "was as few as possible, while meeting service goals" [8]. This is no longer the case. A more complex fulfillment network is now required because retailers who would have previously sold items in-store now have the pressure of competing directly with Amazon's two or one day Prime shipping service.

Amazon's shipping service significantly influenced fulfillment speeds. Shipping speed became a competitive advantage for companies who could adapt their e-commerce fulfillment systems to rival Amazon's speed. Achieving this fast shipping speed requires one major shift from pre-COVID logistic and fulfillment practices: more warehouses. An increase in the number of warehouses provides two main benefits:

Pre-COVID, the shutdown of a single warehouse would cause huge rippling effects because other options were too far to fulfill the closed warehouse's orders in a timely process [9].

Possible Changes in Warehouse Logistics and Fulfilment

Some of the largest retailers in America will invest in warehouse expansion efforts with the increased revenue seen in retail spending during COVID-19. Other retailers will use existing assets as fulfillment contingencies, providing they establish inventory transparency, every store and distribution center alike can support inventory fulfillment efforts.

In times of constant change and fluctuating demand, this current trend for establishing more company-owned warehouses may shift. Matthew White, a strategist at iDrive Logistics, says, "I think that that sense of insecurity among companies who are running their own distribution warehouses will stick, and it will create a trend that favors outsourced" [10].

When consumer demand can be properly calculated, "the lowest cost option for warehousing operations or logistics will often be to stick with one provider, either in-sourced or a single third party," until then, "having multiple partners to call on in a crisis is a plus" [11]. Warehousing companies like Ware2Go, Flowspace, and Flexe have business models that provide "flexibility through redundancy to e-commerce fulfillment," offering numerous warehouses for rent requiring payment only for the space used. During times of fluctuating demand, this may be appealing to many retailers.

How To Adapt Your Workforce To Changes In Retail

The unprecedented growth in e-commerce caused problems for some of the largest companies in America. Regardless if they had established infrastructure to support e-commerce and omnichannel operations at the past levels, logistic lines strained when the demand for skilled online logistic workers rose to meet the needs of scaling up these processes. There was/is a shortage of skilled workers with knowledge in the necessary fields to fulfill orders in the changing market. Workers needed upskilling in topics including:

Upskilling of current employees is still needed as operations continue to grow to support the e-commerce infrastructure. Online logistic and fulfillment changes require workers to learn new ways to make fulfillment quick and efficient. The entire company's workforce must be on the same page and understand how to keep inventory tracked and transparent across the country. New systems for streamlining operations online adopted during the pandemic must be mastered.

Not only did current employees need upskilling because of the increase in warehouses and quick delivery times, but the order fulfillment workforce also increased in size. Companies must train new hires in how the company operates and all the systems used to keep transparency in the fulfillment process.

Using an online learning platform is the way to upskill current employees and train new hires since many offices are closed and in-person interactions are kept to a minimum. Online learning platforms provide an opportunity for a company to upskill and upscale quickly to stay competitive in the retail e-commerce market amidst all the changes.

How Amesite Can Help Your Company Take Its Share of the Ecommerce Market

Amesite is a high-tech AI-powered online learning platform. We specialized in scalable, custom branded online learning environments and content curation to meet the employer's unique needs to support the business's upskilling efforts.

Amesite provides solutions to your problems in a single, easy-to-use platform for upskilling and training. With Amesite, you can:

The solution to your logistic and fulfillment problems lie in upskilling your current employees and training the new hires to successfully use the required technology and systems that support a seamless omnichannel strategy.

Amesite is here to help you facilitate change in your company to meet the changing needs of the e-commerce market. Upskill your employees today. Request a Demo!

References

[1] Digital Commerce 360. Jan 29, 2021. US ecommerce grows 44.0% in 2020. https://www.digitalcommerce360.com/article/us-ecommerce-sales/ Accessed Feb. 8, 2021.

[2] Digital Commerce 360. Jan 29, 2021. US ecommerce grows 44.0% in 2020. https://www.digitalcommerce360.com/article/us-ecommerce-sales/ Accessed Feb. 8, 2021.

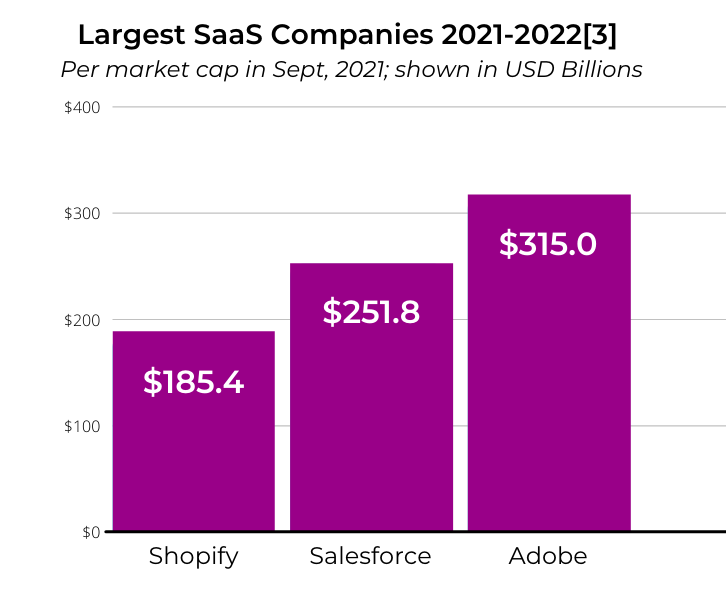

[3] Bmc. September 17, 2021. The State of SaaS in 2022: Growth Trends & Statistics. https://www.bmc.com/blogs/saas-growth-trends/. Accessed October 12, 2021.

[4] Phocus. 2020. What Does Omni Channel Mean For Operations?https://www.phocassoftware.com/business-intelligence-blog/what-does-omni-channel-mean-for-operations#:~:text=True%20Omni%20Channel%20means%20that,and%20pick%20up%20in%20another Accessed Feb. 8, 2021.

[5] Supply Chain Dive. April 21, 2020. Omnichannel comes to the fore as Texas launches plan to reopen retail. https://www.supplychaindive.com/news/coronavirus-texas-retail-omnichannel/576436/ Accessed Feb. 8, 2021.

[6] Supply Chain Dive. May 12, 2020. COVID-19 changed the stakes for e-commerce. Do fulfillment networks need to change too? https://www.supplychaindive.com/news/Coronavirus-e-commerce-logistics-networks/577570/ Accessed Feb. 8, 2021.

[7] Digital Commerce 360. Jan 29, 2021. US ecommerce grows 44.0% in 2020. https://www.digitalcommerce360.com/article/us-ecommerce-sales/ Accessed Feb. 8, 2021.

[8] Supply Chain Dive. May 12, 2020. COVID-19 changed the stakes for e-commerce. Do fulfillment networks need to change too? https://www.supplychaindive.com/news/Coronavirus-e-commerce-logistics-networks/577570/ Accessed Feb. 8, 2021.

[9] Supply Chain Dive. May 12, 2020. COVID-19 changed the stakes for e-commerce. Do fulfillment networks need to change too? https://www.supplychaindive.com/news/Coronavirus-e-commerce-logistics-networks/577570/ Accessed Feb. 8, 2021.

[10] Supply Chain Dive. May 12, 2020. COVID-19 changed the stakes for e-commerce. Do fulfillment networks need to change too? https://www.supplychaindive.com/news/Coronavirus-e-commerce-logistics-networks/577570/ Accessed Feb. 8, 2021.

[11] Supply Chain Dive. May 12, 2020. COVID-19 changed the stakes for e-commerce. Do fulfillment networks need to change too? https://www.supplychaindive.com/news/Coronavirus-e-commerce-logistics-networks/577570/ Accessed Feb. 8, 2021.